Average withholdings from paycheck

Fewer or zero allowances mean more income. Of course each business will have.

Paycheck Taxes Federal State Local Withholding H R Block

The more allowances you claim the less income tax is withheld from your pay.

. But calculating your weekly take-home. Balance of withholding for the calendar year. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return.

Divide line 1 by line 2. How Your Paycheck Works. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

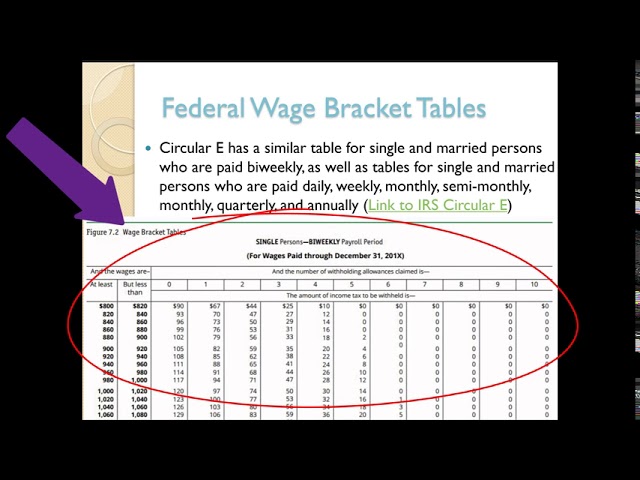

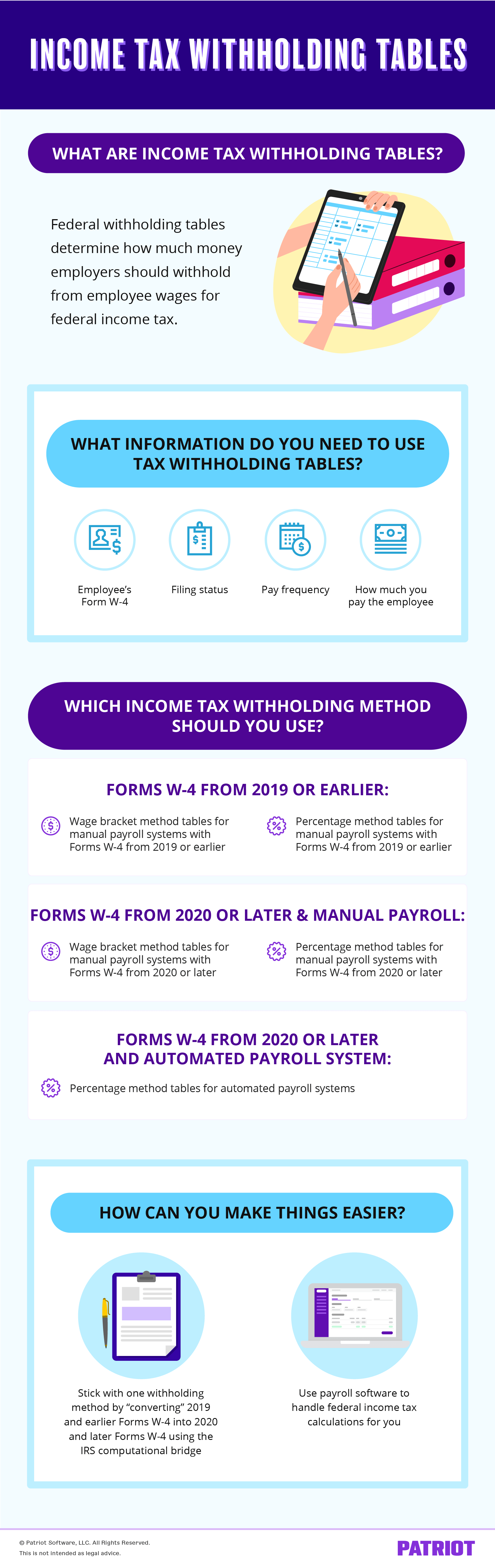

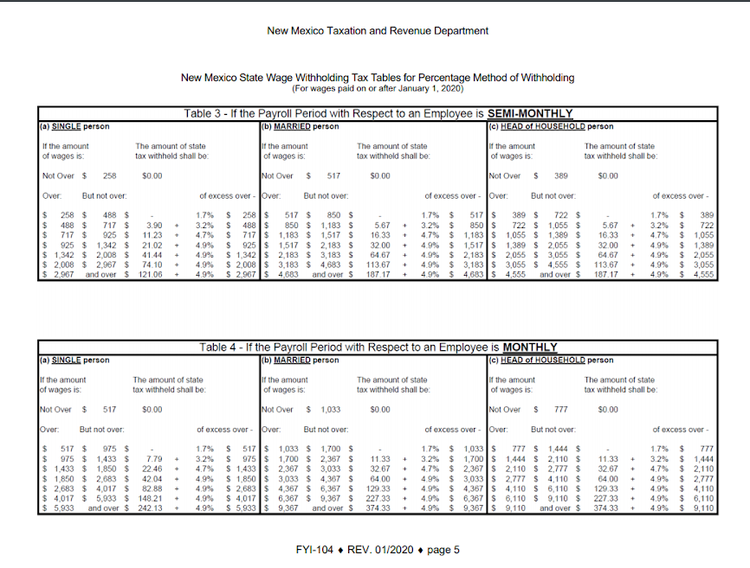

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. Subtract line 5 from line 4. There is an annual income ceiling for.

Lets say the annual salary is 30000. However they dont include all taxes related to payroll. A salaried employee is paid an annual salary.

On average 82 percent of single-person insurance policy premiums are employer covered. Divide line 6 by line 7. The federal withholding tax rate an employee owes depends on their income.

Subtract 1548 from 222491 to arrive at 67691 which. First gather all the documentation you need to reference to calculate withholding tax. The Withholding Form.

10 12 22 24 32 35 and 37. Does claiming dependents increase paycheck. Estimate your federal income tax withholding.

Topping the list is Tennessee with Minnesota and Massachusetts close behind in. But the IRS introduced a new Form. The amount of income tax your employer withholds from your regular pay.

2022 Federal State Payroll Tax Rates for Employers. Make Your Payroll Effortless and Focus on What really Matters. That annual salary is divided by the number of pay periods in the year to get the gross.

Ad Compare 5 Best Payroll Services Find the Best Rates. FICA taxes are commonly called the payroll tax. Weve identified 11 states where the typical salary for a Withholding Tax job is above the national average.

See how your refund take-home pay or tax due are affected by withholding amount. Here are the steps to calculate withholding tax. You find that this amount of 2025 falls in.

Your wages after allowances that exceed 1548 would be subject to a 25-percent tax plus a flat amount of 20105. Ad Choose From the Best Paycheck Companies Tailored To Your Needs. That number drops to 71 percent for family plans.

The federal withholding tax has seven rates for 2021. The withholding rate for Social Security tax for 2018 is 62 percent. This means that your federal tax liability increases as you earn more money.

This is wages per paycheck. Federal tax rates like income tax Social Security. Social Security tax is calculated using gross wages with no deductions.

IRS data shows that the average tax refund for the 2021 tax season was 2856. Both employers and employees are responsible for payroll taxes. FICA taxes consist of Social Security and Medicare taxes.

2 So lets say you got paid twice a month and received the average refund. For employees withholding is the amount of federal income tax withheld from your paycheck. Example rates include 10 percent 25 percent 33 percent and 396 percent.

Simplify Your Day-to-Day With The Best Payroll Services. Use this tool to.

Which Is Better Time Deposit Or Mutual Fund Finance Investing Mutuals Funds Finances Money

Paycheck Withholding Understanding The U S Tax Withholding System

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Calculating Federal Income Tax Withholding Youtube

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Payroll Tax What It Is How To Calculate It Bench Accounting

Check Your Paycheck News Congressman Daniel Webster

2022 Income Tax Withholding Tables Changes Examples

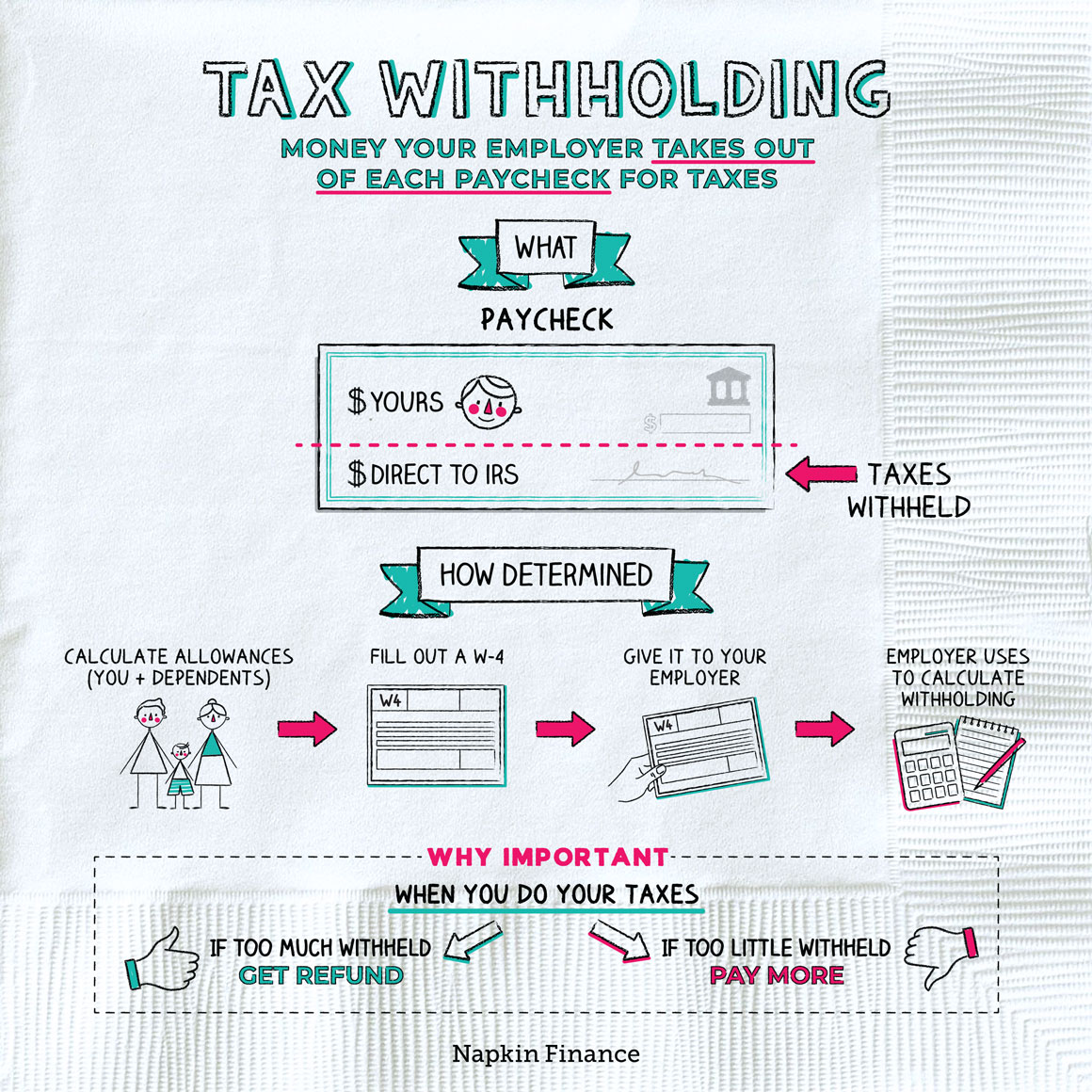

What Is Tax Withholding All Your Questions Answered By Napkin Finance

How To Calculate Payroll Taxes For Your Small Business

What Is Tax Withholding All Your Questions Answered By Napkin Finance

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Tax Withholding For Pensions And Social Security Sensible Money

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

When Is The Best Time To Adjust Your Withholding Tax Forbes Advisor Forbes Advisor